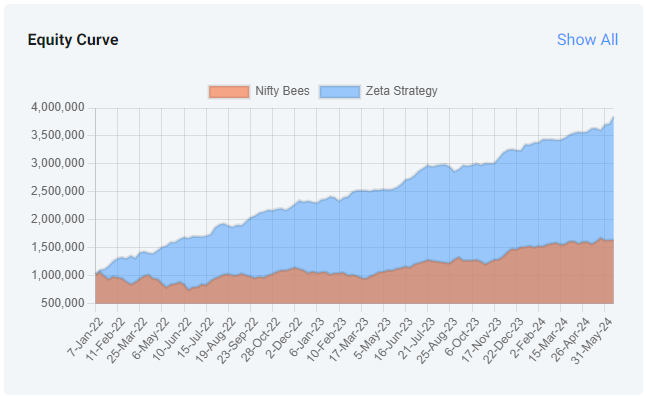

Zeta Strategy is Banknifty Options Writing Strategy. This is a purely intraday strategy. It identifies option shorting opportunity and mostly takes delta neutral position. Although this is similar to classic options strangle this strategy is direction biased. It identifies a combination of Banknifty call and put to short intraday not just with objective of earning theta but also gaining profit by taking position that are direction biased based on certain option parameters and data based indicators.

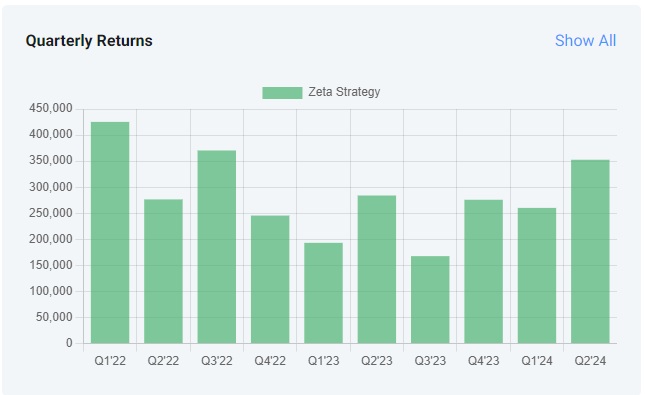

Quarterly Performance

The Zeta Algo Trading System has consistently delivered remarkable returns, achieving an average of 15% QoQ since 2022. The performance graph highlights our strategy's robustness, with no losing quarter and wild swings in performance. This demonstrates the system's efficiency and reliability, making it a compelling choice for investors seeking strong and consistent growth in their portfolios.

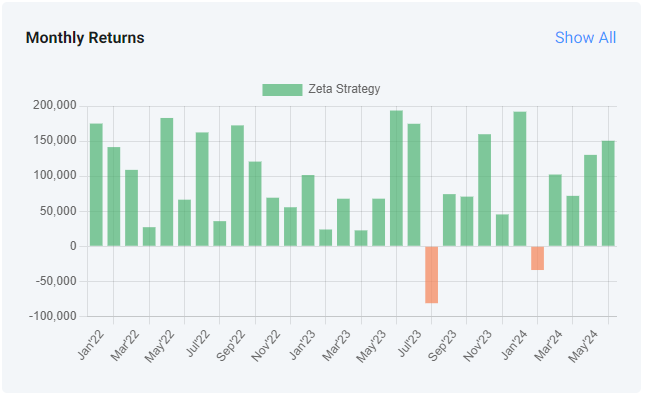

Monthly Returns

The Monthly Returns graph showcases the impressive consistency of the Zeta Strategy. Over the observed period, the strategy has achieved positive returns in 28 out of the last 30 months. This consistent performance, with only minimal instances of drawdowns, demonstrates the strategy's ability to deliver reliable and strong monthly growth.

How System Works

Automated Trading is NOT Unsupervised Trading: Good Past performance is no guarantee of future results. It also extends to the fact that you shouldn't discount an algo simply because it's done poorly recently as it can revert to its usual amazing results in future. Although our algos are 100% fully automated but we do need to interfere manually in times of extreme volatility to safe guard user trade or resolve network and other technical issues, so you're advised to keep a slant eye over the account to monitor any significant deviation or errors.